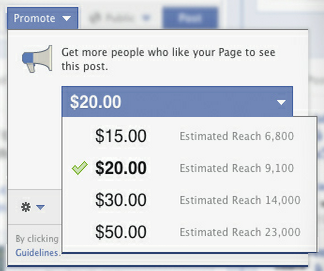

Can someone please explain this to me?

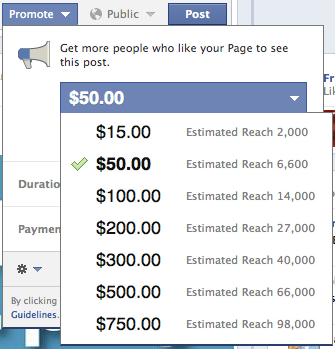

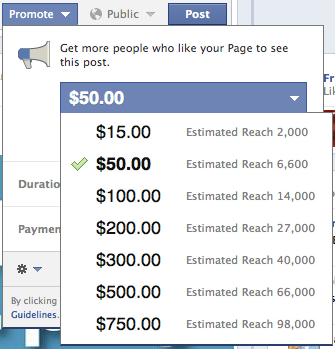

From The 3/50 Project’s Facebook page (91,100 likes):

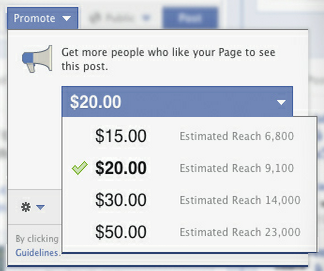

From another organization’s FB page (28,500 likes):

$50.00 buys 23,000 impressions for one admin, but only 6,600 for another?

Sorry if I come across irritated (not really, since I’m the one being shorted 16,400 impressions), but if Facebook via EdgeRank is going to set prices for impressions, it seems a little uniformity would be, ummm…fair. The numbers above clearly paint a picture of successful pages being penalized by inflated pricing.

What prices do you see on your FB page? Curiosity is killing me.

Thanks to RJ for the heads up and shared graphic.

This whole fee thing makes me nuts.

This whole fee thing makes me nuts.

First, banks charged merchants for every single card swipe (both credit and debit) at the register. Didn’t matter that debit cards were “safer” transactions since no extension of credit risk was involved. Businesses still paid full fare for both, on behalf of their customers.

Now that the Dodd Frank bill has been enacted, putting controls in place that limit skyrocketing swipe fees that hammer merchants, banks have begun looking in new directions for additional fees…consumers, and they’re hoppin’ mad.

(Yes, I appreciate the irony. When a merchant paid the fee on behalf of the customer, many consumers saw it as “the cost of doing business.” Now that banks ask customers to pick up part of their own tab, the bristling has begun.) [click here to continue…]

Apparently, there’s yet another crazy idea floating around in Washington–and by “crazy,” I mean “no one has stopped to consider the ramifications of this on Main Street.” A bill recently introduced by Rep. David Schweikert (Ariz.) and Rep. Jeb Hensarling (Texas) is aimed at retiring the dollar bill.

Apparently, there’s yet another crazy idea floating around in Washington–and by “crazy,” I mean “no one has stopped to consider the ramifications of this on Main Street.” A bill recently introduced by Rep. David Schweikert (Ariz.) and Rep. Jeb Hensarling (Texas) is aimed at retiring the dollar bill.

Okay. At first glance, the math makes sense, given what paper currency costs to produce.

But.

When you think about it a moment longer, from a local brick and mortar’s point of view, a few glaring realities come to light: [click here to continue…]

One finger or two? Both are legitimate.

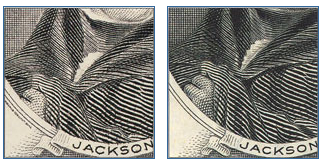

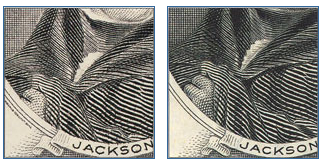

Hearing about a Minnesota woman who sold her car, only to learn later the stack of $100 bills was nothing but counterfeit, made me wonder: How many merchants can spot a fake when it slides across their counter?

Sure, there are counterfeit pens you can use to test each one, but odds are, you’re not testing each and every $5, $10, and $20; most (all) are the real deal. Just in case, though, here’s a quick study guide to help you and your staff pick up on hints that it might be time to grab the marker after all.

http://www.secretservice.gov/know_your_money.shtml

If anything, it’s an interesting read (especially number 3 on the list—Design Features Which Vary On Genuine Currency—which demonstrates how much we don’t notice when looking at a bill).

Independent business owners are often stunned upon learning about the plethora of financial incentives offered to big boxes by cities hoping to snag the next big supercenter. From deep property tax discounts to long term cash infusions to (in the most radical cases) negotiated sales tax payments, the rules are anything but consistent. Big guys get big deals; little guys pay full fare. [click here to continue…]

Independent business owners are often stunned upon learning about the plethora of financial incentives offered to big boxes by cities hoping to snag the next big supercenter. From deep property tax discounts to long term cash infusions to (in the most radical cases) negotiated sales tax payments, the rules are anything but consistent. Big guys get big deals; little guys pay full fare. [click here to continue…]

It’s an age-old story: Single girl, single boy. She’s connected, he’s from the other side of the tracks. He pursues her, she declines (and declines, and declines).

It’s an age-old story: Single girl, single boy. She’s connected, he’s from the other side of the tracks. He pursues her, she declines (and declines, and declines).

But eventually, he finds the magic words. She gives him a chance. They date. Things get serious.

She ignores warnings from those familiar with the fellow while introducing (and defending) him to the family. They make their relationship official, giving him creditability within the circle of influence he’s admired from afar. They’re the golden couple at the Big Holiday Party.

Then, after the holidays have passed, her phone stops ringing. She calls, she emails. She wrestles for scraps of conversation.

After months of heartache, she quietly takes off the ring.

Then it happens. The inevitable. People begin asking questions.

Sadly, this mirrors the brief relationship between The 3/50 Project and American Express. [click here to continue…]

According to a report on CNN, banks are considering limiting the amount of debit card transactions to a paltry $50 or $100? Well folks, if you want to ruin independent brick and mortars, that’s an effective way to do it. [click here to continue…]

According to a report on CNN, banks are considering limiting the amount of debit card transactions to a paltry $50 or $100? Well folks, if you want to ruin independent brick and mortars, that’s an effective way to do it. [click here to continue…]

There’s been a lot of buzz about the Small Business Jobs and Credit Act recently passed in Washington, yet I’m amazed at how many small business owners know little about what’s included for them. From health insurance write offs to erasing capital gains taxes, there’s a lot to be happy about if you’re an independent brick and mortar. In my opinion, one of the best things to come from this is the influx of $30 billion pointed toward smaller, community based banks.

There’s been a lot of buzz about the Small Business Jobs and Credit Act recently passed in Washington, yet I’m amazed at how many small business owners know little about what’s included for them. From health insurance write offs to erasing capital gains taxes, there’s a lot to be happy about if you’re an independent brick and mortar. In my opinion, one of the best things to come from this is the influx of $30 billion pointed toward smaller, community based banks.

You know…the ones who actually loan money to small businesses (unlike their behemoth counterparts that typically don’t).

There’s a pretty concise rundown of the major points on the USA Today website. Check it out, call your accountant, and see if a piece of this pie has your name on it.

According to

According to  There’s been a lot of buzz about the Small Business Jobs and Credit Act recently passed in Washington, yet I’m amazed at how many small business owners know little about what’s included for them. From health insurance write offs to erasing capital gains taxes, there’s a lot to be happy about if you’re an independent brick and mortar. In my opinion, one of the best things to come from this is the influx of $30 billion pointed toward smaller, community based banks.

There’s been a lot of buzz about the Small Business Jobs and Credit Act recently passed in Washington, yet I’m amazed at how many small business owners know little about what’s included for them. From health insurance write offs to erasing capital gains taxes, there’s a lot to be happy about if you’re an independent brick and mortar. In my opinion, one of the best things to come from this is the influx of $30 billion pointed toward smaller, community based banks.